Funding

Research that led to a bond referendum focused on time, money, and realistic outcomes.

GOVERNMENT AID WILL COVER ABOUT 84% OF THE COSTS

Time is still an issue.

- The Federal Emergency Management Agency (FEMA) will reimburse up to 75% of costs, but only after the projects are complete. Cresskill must find up-front funding first.

- Voter-approved state aid of 34% is paid out over time

VOTERS APPROVED THE MOST TIME-EFFICIENT, COST-EFFECTIVE, AND RELIABLE SOLUTION

THE FUNDING PACKAGE

Insurance

The district has two insurance policies: One policy through the federal government’s National Flood Insurance Program (NFIP) for $1 million, and a general insurance policy with extra coverage of $1 million. Because the building is in the 100-year flood plain, this was the maximum available. That general policy already paid out $1 million for the work to drain water, clean up, and protect the building from further damage. An additional $1 million is expected from the NFIP policy. Total insurance coverage was the maximum of $2 million for this disaster, but damages are estimated to be more than $21.6 million.

FEMA

State Aid

New Jersey helps public schools pay for major improvements when voters have committed to pay a share. This arrangement requires that local taxes pay most of the cost, while state aid pays a lesser amount. Cresskill qualifies for state aid of 34% of the remaining project costs after FEMA’s reimbursement. This special kind of state aid is provided to the district over years – as if the state is helping to make payments on a long-term loan. It also requires that the district secure up-front funding.

Local Taxes

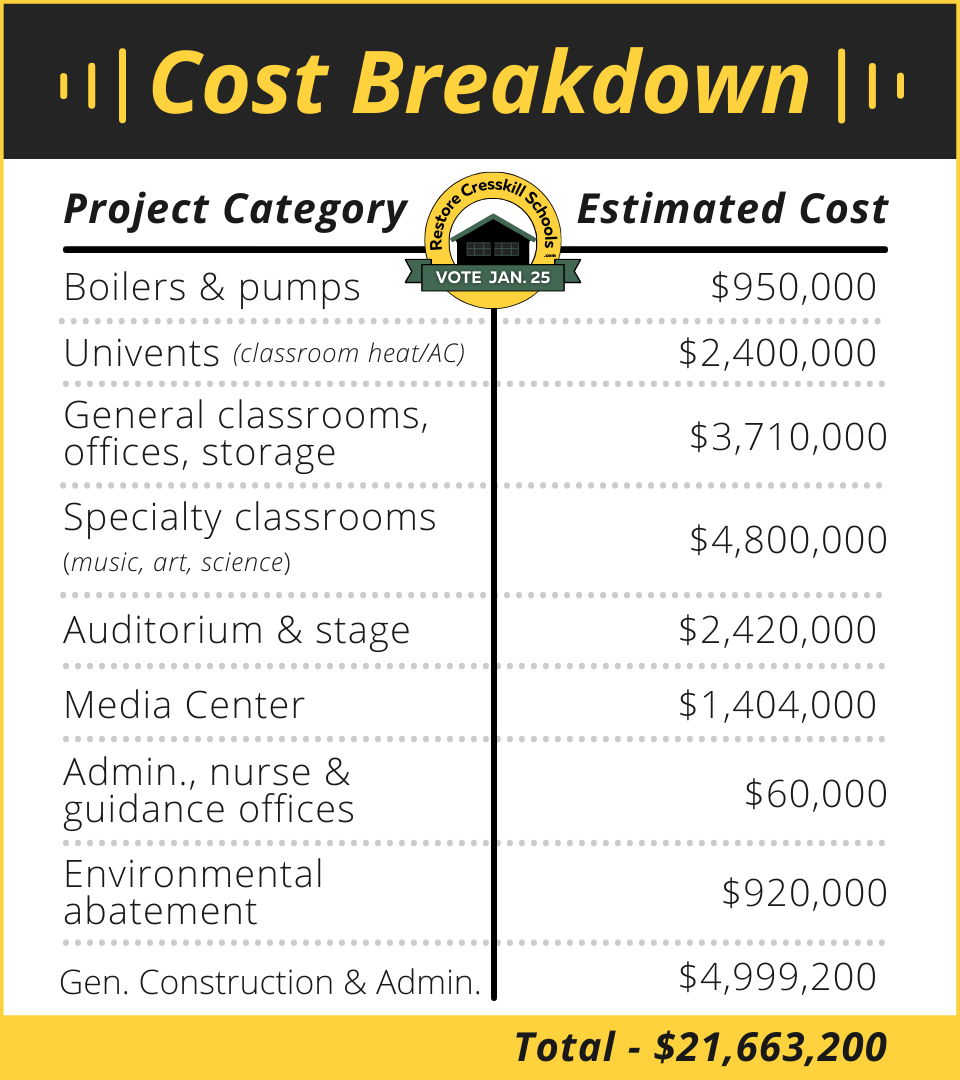

Estimated costs total $21,663,200. After a 75% reimbursement from FEMA, the remainder would be $5,415,800. State aid is verified to pay about 34% of that, reducing the local share to $3,574,428. That local amount –16.5% of total restoration costs – would be paid by Cresskill property taxes.

Taxes are based on a property’s assessed value (not the market value that someone might sell a house for), and in Cresskill the average home is currently assessed at $708,860. Look up your assessment here. On a home assessed at that average, the tax impact is estimated to be about $83 per year. Current estimates are based on a 20-year term for the bonds to be paid back.

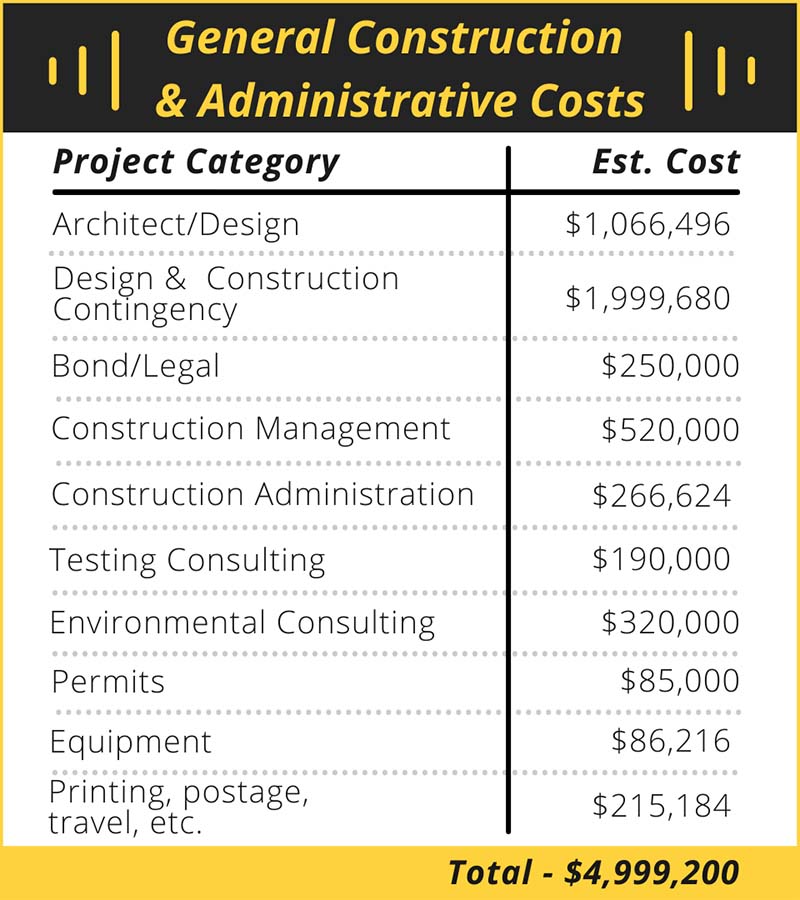

What’s in that $5 million estimate for General Construction & Administrative Costs?

That general set of cost estimates includes the professional design fees, permit fees, on-site management and environmental consulting, among other expenses. These costs are related to the overall restoration work, rather than a specific space to be renovated. They also include contingencies for unknown or unforeseen conditions just in case actual costs are higher. That means the estimated costs are calculated to represent not just physical renovation work, but the entire project that will Restore Cresskill Schools.

ADDITIONAL FINANCIAL BACKGROUND

The district is paying back the funds with a separate tax levy. That will not be billed to the taxpayers until long-term bonds are issued, which may not occur for several years.

FEMA will reimburse costs related to restoration only. Cresskill would give up that funding if it did more than repair and replace what existed before the flood. One exception is the cost of upgrading anything that did not meet current building standards. For example, older floor tiles that contained asbestos will be safely replaced with newer materials, and that upgrade is something FEMA will reimburse for. But otherwise, the FEMA reimbursement only covers replacement of what existed. This offer does not present an opportunity to redesign spaces, upgrade equipment, or build new somewhere else.

State aid comes from revenue collected across the state. It is shared with public school districts where voters have approved bond funding for improvements. Cresskill businesses and residents pay into that, and the only way to bring some of it back to Cresskill is through a voter-approved bond referendum.

Financial estimates are conservative. The interest rate for bonds, for instance, is projected at 3%, which is on the high side for the current market. The bonds will be sold by a process of competitive bidding, which cannot start unless the district has voter approval to borrow. Project costs are also estimated conservatively, with allowances built in for unknown or unforeseen conditions. This conservative approach is designed to complete the projects within the budget.

The Jan. 25th ballot asked to borrow the entire $21.6 million. Cresskill Public Schools will need all the funding secured before ordering supplies and contracting with professional services. When the work is completed, FEMA’s reimbursement will wipe out 75% of that. In fact, the district’s advisors suggest short-term funding for that 75% chunk of the cost, and paying it off just as soon as the FEMA reimbursement arrives. Longer-term funding on the smaller balance would be paid off with state aid and local taxes.

The district would pay back the funds with a separate tax levy. On a homeowner’s tax bill and in the district’s financial records, bond funding is separate from the general operating revenue. The operating budget pays for day-to-day expenses like salaries and utilities. If the district used that budget to pay for building restoration, every dollar would come from the current education program (and there would be no special state aid). Using bond funding qualifies for state aid and leaves the operating budget for regular expenses.